Understanding the Working of Payroll Outsourcing

Much like how the heart is one organ on which the body is heavily dependent, the same way payroll management is the heart of any organisation. Payroll management is as important as getting the right people to work in your company, as not only is it responsible for smooth functioning and managing funds but also it is the means to keep employees happy. And it is no secret that happy employees mean happy employers.

Any organization be it big or small that has been in the industry for some time and has been overseeing their finance for any time allotment, they’d know exactly how much of a serious task it very well is. Regardless of the burden and seriousness organizations have to ensure day in and day out that their company’s money matters are both efficient and just. But often the work demands so much of its employees that the event of generously allotting time to maintaining the right books might end up meaning additional hours for many days and blunder rectification.

It involves the calculation and processing of employee salaries, benefits, and deductions. While managing payroll in-house can be a challenging task, many businesses in Saudi Arabia are turning to outsourced payroll for small businesses to streamline the process.

Outsourced payroll management services in Saudi Arabia offered by many companies, like TASC Corporate Services, offer a range of benefits to businesses, including reduced costs, increased efficiency, and improved compliance. In this article, we will take a closer look at how outsourced payroll management services work in Saudi Arabia.

What are outsourced payroll management services?

Outsourced payroll management services involve hiring an external service provider to handle all aspects of payroll processing. The service provider is responsible for calculating employee salaries, tax deductions, and other payroll-related expenses. They also ensure that all payroll-related documents are filed on time and that the business complies with all relevant laws and regulations.

How do outsourced payroll management services work in Saudi Arabia?

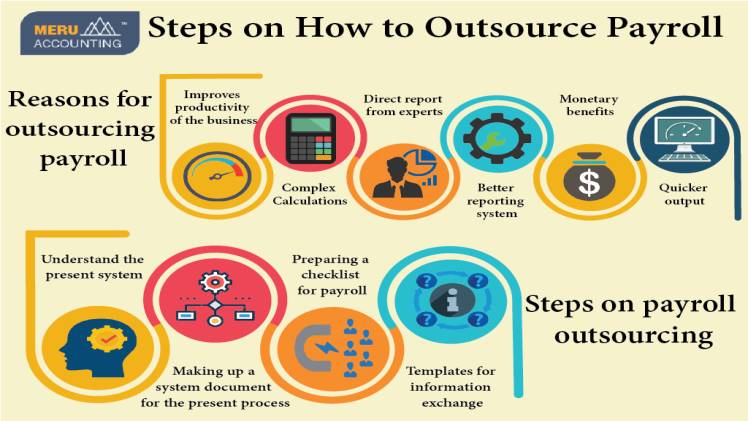

In Saudi Arabia, outsourcing payroll management services typically involves the following steps:

Step 1: Consultation and Needs Assessment

The first step in outsourcing payroll management services in Saudi Arabia is to consult with a service provider. The service provider will assess the needs of the business and determine the most appropriate payroll management solution. This may involve an evaluation of the business’s size, number of employees, and payroll processing requirements.

Step 2: Service Agreement

Once the payroll management solution has been agreed upon, the business and the service provider will enter into a service agreement. This agreement will outline the scope of services to be provided, as well as the terms and conditions of the engagement.

Step 3: Implementation

After the service agreement has been signed, the service provider will begin implementing the payroll management solution. This may involve setting up payroll software, integrating it with other business systems, and ensuring that all relevant data is accurately entered.

Step 4: Payroll Processing

Once the payroll management solution has been implemented, the service provider will be responsible for processing payroll. This includes calculating employee salaries, benefits, and deductions, as well as ensuring that all relevant documents are filed on time.

Step 5: Reporting and Analysis

In addition to processing payroll, outsourced payroll management services in Saudi Arabia also provide reporting and analysis. This includes generating reports on employee salaries, benefits, and deductions, as well as identifying areas for cost savings and process improvements.

Step 6: Compliance

Finally, outsourced payroll management services in Saudi Arabia also ensure compliance with all relevant laws and regulations. This includes ensuring that all taxes and other payroll-related expenses are paid on time and that all payroll-related documents are filed accurately and on time.

As harsh and troublesome as this might sound, this indeed is the reality that many small and medium-sized organizations have to face every business day. As rightly said, necessity is the mother of invention, in the last few years so payroll for small businesses has been emerging, and how so many organizations have begun signing up for their services. What’s getting so many people to sign up for financial services is the fear of losing the company’s assets, including the group’s time.

Regardless of its dramatic emergence and booming industry, there are many still who don’t know or are sceptical of the endeavour. If you are one of those, who is rethinking and planning to remodel the way your company handles financial services, this guide is for you. It will assist you with seeing precisely the way that finance rethinking works and how it could help your business.

Benefits of outsourced payroll management services in Saudi Arabia

There are several benefits of outsourcing payroll management services in Saudi Arabia:

- Reduced Costs

Outsourcing payroll management services can be a cost-effective solution for businesses. It eliminates the need to hire and train in-house staff, and can often be more affordable than investing in payroll software and other systems.

- Increased Efficiency

Outsourced payroll management services can also improve efficiency by streamlining the payroll process. Service providers have the expertise and technology to process payroll quickly and accurately, freeing up time for businesses to focus on other areas of the business.

- Improved Compliance

Outsourced payroll management services also ensure compliance with all relevant laws and regulations. Service providers are responsible for ensuring that all taxes and other payroll-related expenses are paid on time and that all payroll-related documents are filed accurately and on time.

- Access to Expertise

Finally, outsourcing payroll management services in Saudi Arabia provides access to expertise. Service providers have the knowledge and experience to handle all aspects of payroll processing, and can provide advice and guidance on compliance, reporting, and analysis.

Conclusion

The payroll services in Saudi Arabia are at an uphill and most businesses are not just turning their interest in the endeavour but have also started significantly enrolling for the same. Businesses are beginning to realize the benefits of an opportunity like this and how with a certified service provider by your side things could become a lot easier to deal with in the arena of payroll management.